With rising prices and uncertain economic times, it’s easy to feel squeezed by the cost of everyday life. While we can’t control everything—like inflation or government policies—there are plenty of choices we can make to ease the burden on our wallets. Especially when budgets get tight, lowering your cost of living isn’t just a smart move, it’s essential. If debt is making things even tougher, debt relief companies can offer practical help to get you back on track financially. Here’s a fresh look at some simple, doable ways to cut living expenses without sacrificing your quality of life.

Revisit Your Housing Situation

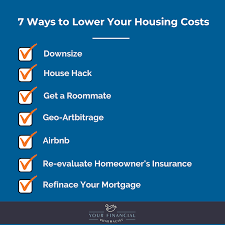

Housing often takes the biggest bite out of your budget, so it’s worth evaluating your current setup. Could moving to a smaller place, a less expensive neighborhood, or even finding a roommate cut costs dramatically?

If moving isn’t an option, try negotiating with your landlord for a lower rent or looking into local assistance programs. Sometimes, refinancing your mortgage at a better rate can also reduce monthly payments, freeing up cash for other needs.

Slash Utility Bills by Being Energy Smart

Energy costs can add up fast, especially if you’re not paying attention to usage. Simple habits like turning off lights when not in use, unplugging devices, using energy-efficient bulbs, and adjusting your thermostat can lower bills noticeably.

Investing in smart thermostats or sealing drafts in windows and doors might cost a little upfront but save you money in the long run. Keeping track of your utility use helps you spot where you might be wasting energy.

Cut Food Costs Without Losing Flavor

Groceries are a huge part of your budget, but cutting costs doesn’t mean eating boring meals. Planning weekly menus, buying in bulk, choosing seasonal produce, and cooking at home instead of eating out saves money and often leads to healthier choices.

Use coupons, store loyalty programs, and cashback apps to get the best deals. Reducing food waste by properly storing leftovers and using all your ingredients stretches your food dollars even further.

Rethink Transportation Expenses

Transportation costs—gas, car payments, insurance—can drain your finances. If possible, consider public transit, carpooling, biking, or walking to reduce expenses.

If you own multiple vehicles, think about whether you can downsize to one or switch to a more fuel-efficient model. Regular maintenance keeps your car running smoothly and prevents costly repairs.

Limit Subscriptions and Unnecessary Services

Subscription services for streaming, magazines, apps, and more add up quickly. Review all your subscriptions and cancel ones you rarely use or can live without.

Also, evaluate recurring expenses like gym memberships or premium cable packages—can you find cheaper alternatives or pause them temporarily? Cutting these “invisible” expenses often surprises people with how much they save.

Find Free or Low-Cost Entertainment

Entertainment doesn’t have to be expensive. Explore free community events, public parks, libraries, or museums with free days.

Hosting potlucks instead of dining out, streaming movies at home, or enjoying hobbies like reading and gardening cost less but still offer joy and relaxation.

Shop Smart for Everyday Items

Whether it’s clothes, toiletries, or household goods, being a savvy shopper helps. Wait for sales, buy quality items that last longer, and use cashback or discount codes.

Consider thrift stores or online marketplaces for gently used goods. This not only saves money but also reduces waste.

Manage and Reduce Debt

Debt payments can seriously strain your budget. If you’re juggling multiple debts, consolidating or negotiating lower interest rates might lower your monthly outgoings.

Debt relief companies specialize in helping people create manageable repayment plans, sometimes reducing the total owed. Freeing up money from debt payments gives you more breathing room for other expenses.

Automate Savings and Bill Payments

Automating your savings and bills helps avoid late fees and encourages steady saving habits. Even small, regular transfers to a savings account build up over time.

Paying bills automatically ensures you don’t miss deadlines, which keeps your credit healthy and prevents extra charges.

Track Your Spending Regularly

Sometimes, costs creep up without us noticing. Keeping track of every expense—even small ones—helps you spot where your money goes and where you can cut back.

Use budgeting apps or simple spreadsheets to stay aware. When you see your spending patterns clearly, it’s easier to make intentional, cost-saving choices.

In Conclusion: Small Changes, Big Impact

Lowering your cost of living is less about drastic lifestyle changes and more about smart, intentional habits. By revisiting housing costs, cutting utility bills, shopping wisely, managing debt, and being mindful of everyday expenses, you can ease financial pressure without sacrificing comfort.

If debt is holding you back, debt relief companies can be a valuable resource, helping you find solutions tailored to your situation.

With patience and commitment, these simple strategies add up—freeing up money and bringing more peace of mind into your daily life.